October 4, 2025

The Indian healthcare market is valued at ₹10.7 trillion in 2024. It primarily comprises 4 segments – Hospitals, Medical Devices, Pharmaceutical, and Diagnostics. Out of these 4 segments, the hospital segment accounts for ~60% of the overall market, i.e. ~ ₹6.4 trillion.

Hospital Classification:

The hospitals can be classified based on 3 parameters:

1) Ownership:

a) Private: 63% of total hospitals, established by individuals, companies, or trusts, primarily funded through patient fees or investments.

b) Government: 37% of total hospitals, funded and managed by central, state, or local authorities to provide affordable care.

2) Services:

a) Primary Care: First point of contact for patients, offering basic medical and preventive services with a few specialties.

b) Secondary Care: Provides both general and specialist services across 5–10 key specialties such as internal medicine, general surgery, gynaecology, paediatrics, and orthopaedics. It typically has 50–300 beds.

c) Tertiary/Quaternary Care: Equipped with highly specialised staff and advanced technology to manage complex conditions such as cardiology, neurology, oncology, critical care, and trauma. It is often involved in education and research. Usually, it has 300+ beds with highly differentiated clinical services.

3) Specialty:

a) Single-specialty: Concentrates on one area of expertise, such as cardiology, oncology, or orthopaedics, delivering highly focused care.

b) Multi-specialty: Brings together multiple departments and specialties, enabling comprehensive treatment for a wide range of medical needs in a single facility.

Key Industry Insights:

1) Cyclicality:

Healthcare services are relatively insulated from the broader economic cycles of boom and bust. Unlike discretionary sectors such as real estate, automobiles, or luxury goods, the demand for healthcare is non-discretionary.

People fall sick, require surgeries, or need emergency and chronic care regardless of whether the economy is expanding or contracting. This makes hospitals and healthcare providers face low cyclicality in demand, offering them a steadier revenue base compared to the other industries.

Interestingly, during economic slowdowns, while discretionary healthcare spending (like cosmetic procedures or premium wellness packages) may see some moderation. However, the core demand for inpatient and outpatient care, critical treatments, and emergency services remains largely unaffected.

Moreover, the rising prevalence of chronic diseases (like diabetes, hypertension, and cancer) and growing health awareness further boost the structural demand for hospital services, independent of short-term GDP fluctuations. This defensive characteristic makes the healthcare sector attractive for long-term investors.

2) Sector Expenditure:

The Indian government spends about 3.5% of its GDP on healthcare, which is significantly lower than the US (16.9%), Brazil (9.5%), the UK (10.0%), Vietnam (5.9%) and the global average of 8%.

The country has around 12 lakh private hospital beds and 8 lakh government hospital beds, translating to ~15 beds per 10,000 people. This is half of the global average of 29 beds per 10,000 people.

As per the recent report of ICRA, 11 listed and 2 major unlisted hospital chains will add around 14,500 beds by FY27, doing the capex of ₹32,000 crore.

3) Construction Period:

Building a hospital is a long and capital-intensive task. It is influenced not only by the size of the hospital but also by the complexity of medical infrastructure, availability of land, and regulatory approvals.

Primary care hospitals, usually 10 to 50 beds with basic outpatient and minor inpatient facilities, are the quickest to come up, often taking around 12 to 18 months if land and permissions are in place.

Secondary care hospitals, which range from 50 to 300 beds and include core specialties like general medicine, surgery, gynaecology, orthopaedics, and paediatrics, take longer to build, typically 2-3 years, as they require modular operating theatres, ICUs, diagnostic labs, and more stringent compliance standards.

Tertiary or super-specialty hospitals, with 300 or more beds and advanced care such as cardiology, oncology, neurology, and organ transplants, demand the most time. These large-scale projects often stretch across 4-6 years, and in metro cities, timelines may extend even further due to land acquisition challenges, environmental clearances, and multiple regulatory approvals.

In fact, for teaching hospitals with medical institutes attached, the process can take even longer since residential and academic infrastructure must also be developed alongside clinical facilities.

For example, the 100-bed government hospital at Parigi, Telangana, sanctioned in 2024 with a budget of ₹26 crore, is expected to take about 18–20 months to complete.

On the other hand, the Medanta Medicity project in Gurugram, a 1,250-bed integrated facility, took almost 5 years from conceptualisation in 2004 to inauguration in 2009.

4) Revenue Sources:

Broadly, hospitals generate revenue from 4 sources:

a) Inpatient services (IPD): These services are the backbone of hospital revenues, as they include admissions, bed charges, surgeries, procedures, ICU care, and nursing. Hospitals earn the majority of their income here, typically accounting for 40–60% of total revenue. While fixed costs are high, the steady inflow of admitted patients ensures consistent earnings.

b) Outpatient services (OPD): These include doctor consultations, minor procedures, and routine check-ups. They act as the entry point for most patients. Although consultation fees themselves are low-margin, the OPD plays a critical role in feeding patients into the inpatient pipeline.

c) Diagnostics: It represents one of the most profitable revenue streams for hospitals. Once high-cost equipment like an MRI or CT machine is installed, the marginal cost per additional test is very low, making this a high-margin business.

d) Pharmacy: It is another significant contributor, particularly for large hospital chains. Hospitals capture demand by selling medicines, consumables, and surgical items directly to inpatients and outpatients. Strong procurement practices and supplier tie-ups can keep margins attractive.

5) Cost Structure:

Normally, there are 5 key cost centres for the hospital – Medical Professionals, Medical Consumables & Drugs, Infrastructure and Facility, Medical Equipment Depreciation & Maintenance, and Administrative Overheads.

Medical professionals typically account for 40-55% of total operating costs. Usually, hospitals have doctors either on payroll or on a visiting basis. Employing a large number of doctors on the payroll ensures better patient experience, as doctors are more easily available, but it also raises fixed costs and puts pressure on profitability.

On the other hand, relying heavily on visiting doctors keeps costs lower but dilutes the hospital’s brand identity, since doctor availability becomes less predictable.

The next largest component is medical consumables and drugs, including implants, disposables, and medicines, which contribute around 20-25% of operating costs and can be higher in specialties such as oncology or orthopaedics.

Infrastructure and facility-related expenses, including rent or lease payments, housekeeping, utilities, and maintenance of buildings, generally absorb another 10-15%, while the depreciation and upkeep of high-end medical equipment like MRIs, catheterisation labs, etc., add about 8-12%. Lastly, administrative overheads such as marketing, IT systems, training, and accreditation contribute roughly 5-10%.

6) Doctors’ Payment Structures:

The easy way to generate revenue for a hospital is by hiring specialised doctors with decent years of experience and an existing patient base. However, this is the biggest cost centre. Usually, there are 3 types of payment structures between the doctor and the hospital.

a) Minimum Guarantee (MG) Model: A minimum guarantee is a contract where the hospital promises a doctor a fixed minimum monthly income, even if the doctor doesn’t see enough patients to earn that much. It gives the doctor income security when joining a new hospital, while allowing the hospital to attract reputed specialists.

Normally, the doctors get 20-25% of the total revenue generated by them for the hospital. Suppose a cardiologist joins a private hospital with an MG of ₹5 lakh/month. In 1st month, the doctor’s revenue share is ₹3 lakh. Hospital still pays ₹5 lakh (topping up ₹2 lakh). Now, in the 6th month, the doctor starts generating a great amount of revenue, and the revenue share rises to ₹8 lakh. The doctor gets ₹8 lakh (no top-up, since MG level already crossed).

If the hospital wants to increase its revenue aggressively and pull patients, it tends to hire more and more super-specialists. However, this strategy might hurt the profit margins in the short term.

b) Fee For Service (FFS): Doctors are paid based on the actual services they perform, like consultations, diagnostic procedures, or surgeries. There is no fixed monthly guarantee. Income depends entirely on patient volume and the type of services.

The hospital and doctor agree on a revenue-sharing ratio. For every service billed to the patient, the hospital collects the payment and then gives the doctor their agreed share.

c) Salaried: In the salaried model, a doctor is hired by the hospital as a full-time or part-time medical professional. The doctor receives a fixed monthly salary, regardless of the number of patients seen or procedures performed. It’s just like any other employment contract that has predictable income and less financial risk for both hospital and doctor.

7) Billing Models:

a) Package Cost: In the package cost model, hospitals charge a fixed, pre-decided amount for a particular treatment or surgery. This package usually covers room rent, doctor fees, nursing, consumables, and basic investigations, giving patients clarity and predictability of expenses. It is widely used for common procedures like deliveries, cataract surgeries, or bypass operations.

b) Open Billing Cost: In open billing, patients are charged separately for every component of their care, like consultation fees, room charges, diagnostics, medicines, consumables, and procedures. This model reflects the actual usage and can vary significantly depending on patient condition and length of stay, leading to higher unpredictability in final bills.

8) Hub and Spoke Model:

The hub-and-spoke model is an emerging strategy in the Indian hospital sector to expand reach while optimising resources. In this setup, hospitals establish a central “hub” facility supported by a network of smaller “spoke” units spread across different locations.

Spokes (Feeder Units): These are smaller hospitals, clinics, or diagnostic centres located in semi-urban or rural areas. They typically provide primary consultations, basic diagnostic tests, routine check-ups, and minor treatments. The cost of setting up and running them is lower, and they help build the hospital’s local presence and patient trust.

Hub (Referral Centre): The hub is a large, tertiary care hospital equipped with advanced infrastructure, specialised doctors, and high-end technology for complex procedures such as cardiac surgery, neurosurgery, oncology treatments, or organ transplants.

How it works: Patients first approach a spoke for their basic healthcare needs. If a case requires advanced intervention, the spoke refers and channels the patient to the hub. This ensures that routine care is delivered close to patients’ homes, while serious conditions are efficiently escalated to a facility capable of handling them.

9) New Age Business Models:

There are innovative business formats that hospitals are adopting to expand faster, reduce upfront capital cost, and improve efficiency. Here are some of the business models:

a) Lease-Based Hospitals: Instead of buying land and building from scratch (which is very capital-intensive), hospitals lease existing infrastructure (like an old hospital, commercial building, or government facility) and convert it into an operational hospital.

b) Operations & Management (O&M) Contracts: Hospitals manage and operate facilities owned by another party (such as a trust, government, or investor). The owner provides infrastructure, while the hospital brings in its brand, doctors, systems, and management expertise.

c) Franchise-Based Satellite Centres: Hospitals allow smaller clinics or diagnostic centres to use their brand and protocols in exchange for a fee or revenue share. These satellite centres mainly handle OPD, diagnostics, or day-care, and refer patients needing advanced care to the main hospital hub.

d) Medicity: A Medicity is like a healthcare city. It is a large integrated medical campus that combines hospitals, diagnostics, research, education, pharma, and wellness under one umbrella. It functions like an ecosystem, attracting domestic and international patients.

Hospitals are turning to new-age models to overcome the high capital intensity and long payback of traditional hospital projects.

Building a large tertiary hospital can cost over ₹1–3 crore per bed, making expansion slow and risky, especially in Tier-2 and Tier-3 cities.

To scale faster, hospital chains now adopt asset-light formats such as lease-based hospitals, O&M contracts, and franchise-based satellite clinics, which reduce upfront investment and improve return on capital. These spoke-like units also serve as feeders to larger hubs in metro cities.

At the premium end, Medicity formats that are integrated healthcare ecosystems combining hospitals, research, and education are gaining traction, particularly for medical tourism.

For instance, Apollo Clinics act as neighbourhood OPD and diagnostic centres that channel patients into Apollo’s larger hospitals, while Medanta Medicity in Gurugram showcases the integrated model by offering super-specialty care, research, and training under one campus.

10) Expansion:

Generally, hospitals explore 3 options to expand their operations and presence:

a) Expansion within the city: Hospitals open new branches in the same city where they already have a strong brand presence. Patient trust and doctor reputation are already established, so scaling is faster with relatively lower risk. The payback period is usually 2-3 years.

b) Brownfield expansion: This involves adding new beds, ICUs, or new specialties within an existing hospital. Since infrastructure, staff, and brand are already in place, incremental investments have the quickest payback and highest return. The payback period is 6-8 months.

c) Expansion into a new city: Entering a new geography requires building brand awareness, attracting new doctors, and educating patients. The ramp-up is slower, capex is higher, and breakeven typically takes several years. In some cases, the payback period is 6-7 years.

11) Competition Intensity:

Competition in the Indian hospital sector varies significantly depending on the type of facility. Multi-specialty hospitals typically face lower competition because the barriers to entry are high. Building a multi-specialty hospital requires massive capex, availability of land in prime locations, advanced medical infrastructure, and the ability to attract and retain a large team of specialists across the domains.

Once established, multi-speciality hospitals also enjoy strong brand loyalty, as patients prefer the convenience of having multiple services under one roof. This makes it difficult for new entrants to replicate their scale quickly.

On the other hand, single-specialty hospitals (such as eye hospitals, dental clinics, fertility centres, or small cardiac setups) face much higher competition. The entry barriers are lower as these facilities require smaller spaces, focused teams, and more modest investment. As a result, the market is highly fragmented, with numerous regional players competing on price, doctor reputation, and patient experience.

The market structure is also uneven: multi-specialty hospitals are consolidating under large chains like Apollo, Fortis, and Narayana, whereas specialties like eye care, fertility, and dental remain highly fragmented, with hundreds of small, local players. Further, tie-ups with insurance providers and government schemes like Ayushman Bharat are becoming competitive levers, often giving larger hospitals a distinct edge over standalone facilities.

Interestingly, competition is also more regional than national. A hospital chain might dominate in one or two states yet remain a minor player in other states. For instance, KIMS Hospitals has a strong presence in Telangana & Andhra Pradesh, Aster DM Healthcare has a strong presence in Kerala & Karnataka, and Narayana Hrudayalaya has a strong presence in Karnataka & Eastern India (Kolkata hub).

12) Regulatory Challenges:

Building and operating a hospital in India is rife with regulatory and institutional hurdles. Hospitals must secure a multitude of permissions and clearances from central, state, and local bodies: building permits, change-of-land-use (CLU) permissions, fire safety NOCs, environmental impact clearances, health department licenses, radiation permits (for X-ray/CT/MRI), biomedical waste handling approvals, and often multiple inspections from municipal, pollution control boards, and health/medical councils.

Land availability is also a serious constraint, especially in dense metro areas. Acquiring plots large enough to accommodate hospital buildings, parking, circulation, and future expansion is tough and expensive. Even when land exists, restrictions such as height limits or plot use zoning often block development. For example, hospital projects in Ahmedabad have stalled due to a 45-meter height limit imposed under fire safety norms.

In the past, the government has intervened in the tariffs charged by the hospitals, which resulted in a decline in profitability. The government has placed price caps on certain medical devices (such as cardiac stents, knee implants) by classifying them as essential medical products under the National List of Essential Medicines. In some cases, private hospitals have been regulated on package rates for procedures in government schemes or national health insurance programs.

For instance, under the Ayushman Bharat / government health insurance schemes, hospitals are sometimes penalised if they charge patients above the approved rates. In Varanasi, authorities cracked down on hospitals charging ineligible fees to Ayushman beneficiaries.

13) Talent Pool Acquisition:

One of the structural advantages for hospitals that operate their own medical colleges or training institutes is direct access to a steady pipeline of talent. In India, the availability of skilled doctors, nurses, and allied health professionals is often a bottleneck, especially for fast-growing private hospitals in Tier-2 and Tier-3 cities.

Hospitals without their own medical institutes rely on external hiring, which can be slow, costly, and vulnerable to high attrition, particularly when competing for star consultants or specialist staff.

By contrast, hospitals that run medical colleges or nursing schools can train, absorb, and retain their own talent pool. This not only ensures better availability of medical professionals but also allows such hospitals to ramp up bed utilisation and expand new departments more smoothly.

Moreover, in-house institutes help inculcate the hospital’s protocols, culture, and values from the start, leading to better alignment between staff and management. These institutions also contribute to the hospital’s reputation, attracting patients who associate teaching hospitals with advanced care and research. In fact, teaching hospitals often become regional referral centres due to the combination of specialist expertise and academic credibility.

Some of the examples include the All India Institute of Medical Sciences (AIIMS) in Delhi and its branches, which operate as both treatment hubs and premier teaching centres, Christian Medical College (CMC) Vellore, which is globally respected for producing doctors and nurses while running a 3,500+ bed hospital.

Kasturba Medical College (part of Manipal Hospitals) and Sri Ramachandra Institute of Higher Education & Research in Chennai, which integrates hospital services with medical education. Even private chains like Apollo Hospitals have set up the Apollo Institute of Medical Sciences and Research to secure long-term talent.

14) Funding Challenges:

The hospital industry in India is heavily reliant on the banking system to meet its funding requirements, as access to capital markets is generally limited to a handful of large corporate players.

This overdependence on bank loans often leads hospitals to use short-term borrowings for projects that actually require long-term capital, such as building new facilities or adding bed capacity.

Such mismatches create refinancing risks, especially when liquidity in the financial system tightens or interest rates rise sharply. In these situations, hospitals may face difficulty rolling over debt or may be forced to refinance at higher costs, which declines their profit margins.

The challenge is compounded by the long payback periods typical of healthcare projects, which makes stable, long-term funding critical for the sector’s growth.

15) Medical Tourism:

Medical tourism is gaining traction in India largely because of the combination of high-quality care, lower cost, and minimal wait times. International patients often seek complex surgeries, transplants, and specialised treatments where Indian hospitals can deliver world-class outcomes at a fraction of the cost.

The Indian government’s “Heal in India” initiative, relaxed medical visa rules, and investments in hospital accreditation also support this trend.

On the cost front, the savings are dramatic. A heart bypass surgery might cost between $4,000 and $6,000 in India, compared to $80,000 to $120,000 in the U.S. Similarly, hip or knee replacements offered in India range from around $4,000 to $5,000, versus tens of thousands of dollars in developed countries.

Since international patients often pay cash and aren’t constrained by local insurance caps, margins in medical tourism tend to be higher than in domestic business.

Imported consumables, luxury services, and premium packages command better pricing. Also, the inbound-patient mix is biased toward high-cost procedures (e.g., cardiology, orthopaedics, oncology), which increases average revenue per patient.

Because of the strong cost arbitrage and reputation effects, many hospitals now regard their medical-tourism verticals as showcases or marketing engines.

They use those cases to build brand credibility in both the domestic and international markets. Also, many hospitals bundle “tourism + treatment” packages (accommodation, transport, translator services), which add ancillary revenue streams.

Key Industry Metrics:

1) Inpatient and Outpatient:

Hospitals serve patients in two broad categories: outpatients (OP), who come for consultations, diagnostics, or minor procedures without admission, and inpatients (IP), who are admitted for surgeries, intensive treatments, or extended care.

Outpatient volume is critical because it acts as the funnel that feeds the inpatient department, which typically generates the bulk of hospital revenues.

Hospitals also track OP-IP conversion. It refers to the percentage of outpatient visits that eventually result in inpatient admissions. For example, if a hospital sees 1,000 outpatients in a month and 100 of them are admitted for further treatment, the OP–IP conversion rate is 10%. Generally, the industry average is 8-12%.

This metric is crucial because while OPD consultations generate modest revenue, converting a portion of these patients into admissions leads to much higher revenue per patient.

2) Average Revenue Per Occupied Bed (APROB):

ARPOB measures the average revenue generated per bed that is actually occupied over a given period (usually per day, per month, or per year). ARPOB reflects both the pricing power of a hospital and the case mix of patients.

Primary care hospitals, which handle basic services and minor procedures, have the lowest ARPOB since their billing per patient is limited. Secondary care hospitals, with general surgeries and a few specialities, record moderate ARPOB as their treatment complexity and resource use are higher.

Tertiary and super-speciality hospitals report the highest ARPOB because they deal with advanced procedures such as cardiac surgeries, oncology treatments, and organ transplants.

3) Average Length of Stay (ALOS):

ALOS measures the average number of days a patient spends in the hospital from admission to discharge. It is a key operational metric that indicates how efficiently a hospital manages patient flow and bed utilisation.

A lower ALOS generally reflects better clinical efficiency and faster patient turnover, provided it is not achieved by compromising quality of care.

When the ALOS is high, it often reduces overall revenue efficiency. This is because hospitals typically earn the majority of their revenue during the first 1 or 2 days of a patient’s admission through diagnostics, procedures, and intensive treatments.

Beyond that, the daily room rent and basic care contribute relatively little compared to the initial days’ revenue. In short, the same bed is occupied for longer with diminishing incremental revenue, reducing both patient turnover and ARPOB.

4) Payor Mix:

The payor mix refers to the composition of patients in a hospital based on who pays for their treatment, such as international patients, domestic out-of-pocket paying patients, insurance, and patients admitted under government health schemes.

A balanced payor mix is critical for the financial health of a hospital because it directly impacts both revenue realisation and the cash conversion cycle.

Hospitals benefit most from cash-paying, insured, and international patients, since these patients provide higher pricing power, quicker payments, and better margins.

In contrast, patients admitted under government or institutional schemes generally bring lower realisation rates due to capped treatment prices and also involve longer payment cycles.

Insurance patients tend to have a payment cycle of ~30-45 days (mainly for completion of documentation formalities from the Third-party administrator), while the government schemes’ patients can have a payment cycle of as long as 8 months.

While the government schemes reduce profitability and put pressure on the working capital cycle, such schemes can help hospitals maintain steady patient volumes and provide a cushion against the high fixed costs of running large facilities.

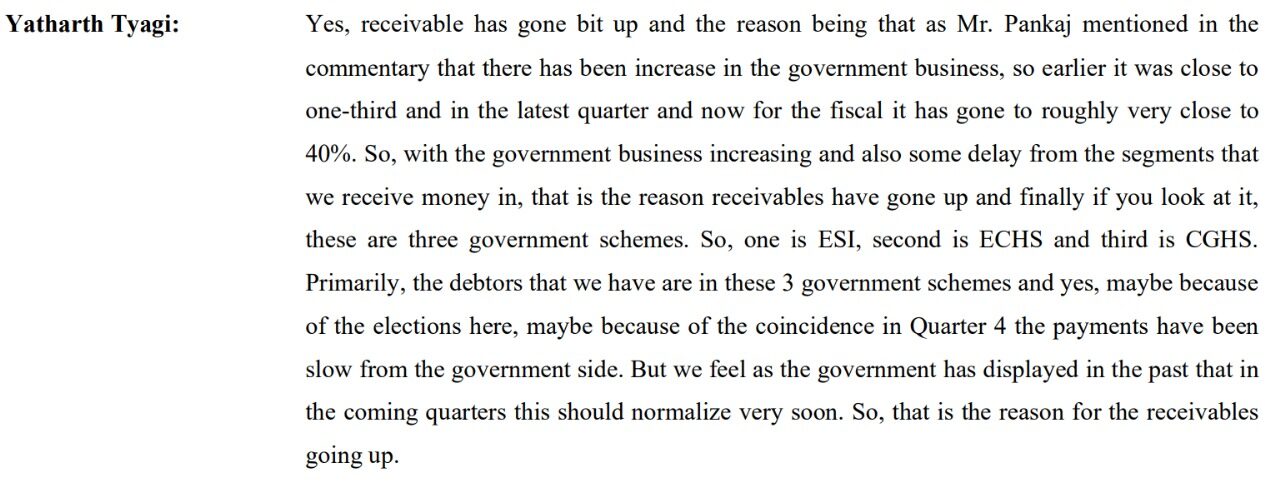

For example, the cash flow from operations of Yatharth Hospital & Trauma Care Services turned negative in FY24 due to increased contributions from the patients under government schemes. This resulted in increased trade receivables.

Yatharth Hospital’s Q4FY24 concall transcript excerpt:

5) Occupancy Rate:

Occupancy rate is a key operating metric that measures the percentage of hospital beds that are occupied by patients over a given period. It indicates how efficiently a hospital is utilising its available bed capacity and is closely tied to both revenue generation and cost absorption.

In India, the typical occupancy rate for private hospitals ranges between 60% and 70%, though mature and well-established tertiary hospitals in metros can achieve 75–80%.

Ramp-up of occupancy rate is rarely immediate. A new hospital can take 2–3 years to reach a breakeven occupancy of ~50–55%, and about 4–5 years to reach stabilised levels of 65–70%.

The ramp-up depends on several factors: the brand reputation of the hospital, availability of star doctors, location (metro vs Tier-2/3 city), competitive intensity in the region, and the payor mix.

6) Specialty Mix:

Specialty mix refers to the spread of revenue across different medical specialties. Instead of depending heavily on a single specialty, hospitals build a balanced specialty mix to stabilise revenues and optimise profitability.

Within the industry, there is a commonly used term called CONGO, which stands for Cardiac, Oncology, Neuro, Gastro, and Orthopaedics. These five specialties are considered the “powerhouse” verticals of tertiary hospitals because they involve high-complexity, high-value procedures such as bypass surgeries, cancer treatments, brain surgeries, liver transplants, and joint replacements. Together, they typically contribute the majority of revenues in large multi-specialty hospitals.

The specialty mix of a hospital has a direct effect on its EBITDA margins. Specialties such as oncology, cardiology, and orthopaedics tend to be higher-margin businesses because they involve complex procedures, expensive packages, and higher realisation per patient.

Private Equity Interest and Market Consolidation:

Private Equity (PE) funds have been consistently bullish on India’s hospital sector because it combines defensive demand with strong long-term growth potential. As a result, global funds like TPG, KKR, Temasek, and Blackstone have made multi-billion-dollar bets on large chains such as Manipal, Medanta, and Aster.

Between 2022 and 2024, Indian hospitals recorded M&A deals worth $6.74 billion and secured $4.96 billion in PE investments. The hospitals accounted for ~38% of the total healthcare PE deal value in India.

Alongside PE interest, the industry is seeing rapid consolidation. Larger hospital groups are acquiring smaller regional players to quickly expand capacity and gain a foothold in Tier-2 and Tier-3 cities.

For example, Manipal’s acquisition of Columbia Asia and later Vikram Hospitals in Bengaluru, or Fortis and Apollo expanding through regional buyouts, reflect how the inorganic route offers faster scale than building greenfield hospitals.

Consolidation is also driven by doctor retention and brand strength. Smaller standalone hospitals often struggle to attract and retain top consultants, making them more vulnerable to acquisition by bigger networks.

For the larger chains, acquisitions not only bring additional beds but also deepen doctor networks, enhance bargaining power with insurers, and improve their payor mix, thereby strengthening EBITDA margins.

Thank you for taking the time to read the article. I hope you found it valuable and insightful.

Disclaimers:

1) I am not a SEBI-registered Research Analyst.

2) I do not own the stocks mentioned in the article as of the published date.

Related Articles

Hotel Industry Analysis

The hotel industry is highly cyclical. The demand generally rises in economic booms (when corporations spend, people travel, and discretionary incomes rise) and falls in economic downturns. There’s also seasonal demand variation: for many hotels, demand peaks during...